May 2024

Flight to Safety or Breakthrough? Resurgence of ADCs and Radiopharmaceuticals

- Antibody-drug conjugates (ADCs) and radiopharmaceuticals have re-emerged as modalities of high interest, with most major oncology players making acquisitions in one of these areas.

- Both modalities leverage proven approaches to fighting cancer, with the aim of improving efficacy through targeting, and longer time-to-negotiation under IRA.

- The vast majority of programs in development are going after the same tumor types, however, suggesting potential high competition ahead.

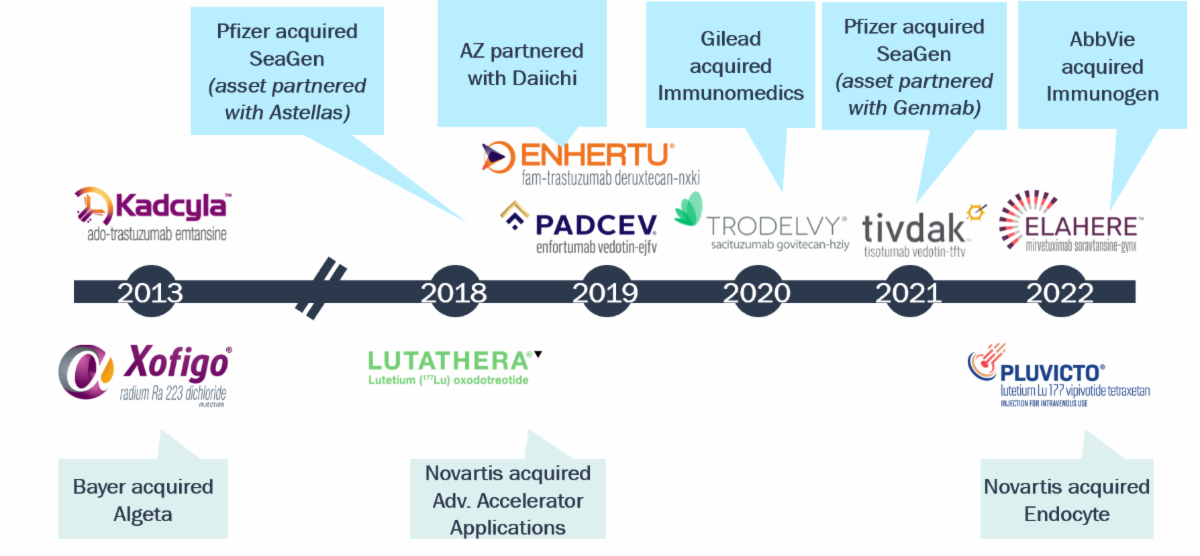

ADCs and radiopharmaceuticals have re-emerged as modalities of high interest; all approved products have been tied up by big pharma

Initial FDA Approval of ADCs and Radiopharmaceuticals in Solid Tumors

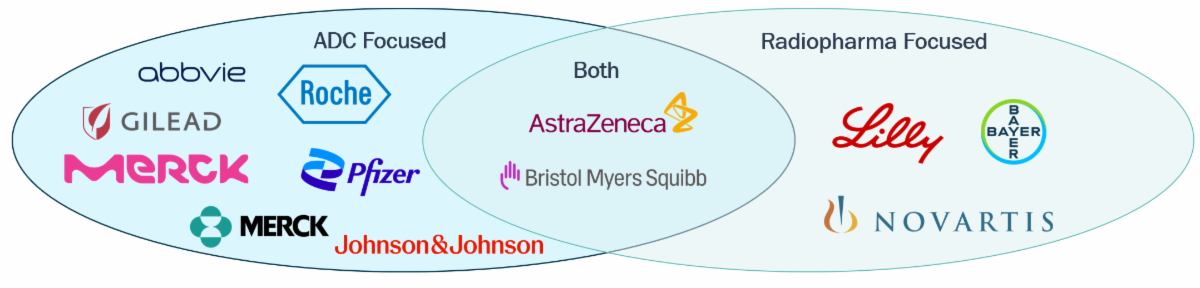

Most major oncology companies have invested in ADCs, with AZ and BMS the only top ones with major investments in both modalities

Focus Areas for Top Pharma Companies (PhII+ Solid Tumor Programs)

Notable Transactions

ADCs

- Pfizer acquired SeaGen

- Merck and AbbVie executed major transactions to get access to onmarket/late stage programs

Both

- BMS invested in derisked target ADCs (FOLR1, EGFRxHER3) and acquired RayzeBio

- AZ continues expansion of Enhertu with Daiichi, acquiring Fusion with PhII PSMA alpha emitter

Radiopharma

- Novartis doubles down on radiopharma with announced Mariana Oncology acquisition

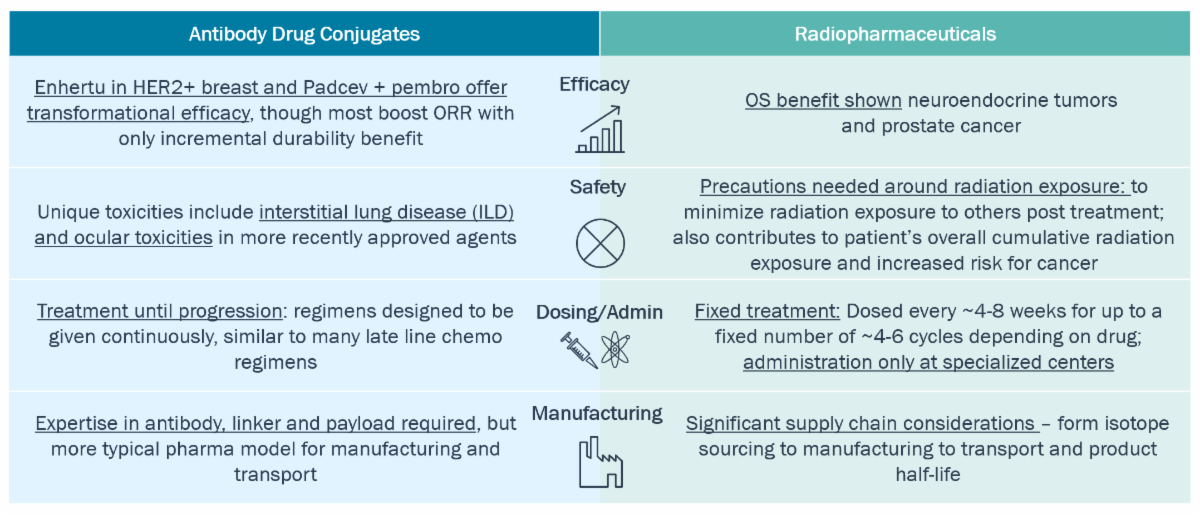

Both modalities have demonstrated efficacy improvement but come with novel toxicity, admin, and manufacturing considerations

Comparison of Drug Modalities: ADCs and Radiopharmaceuticals

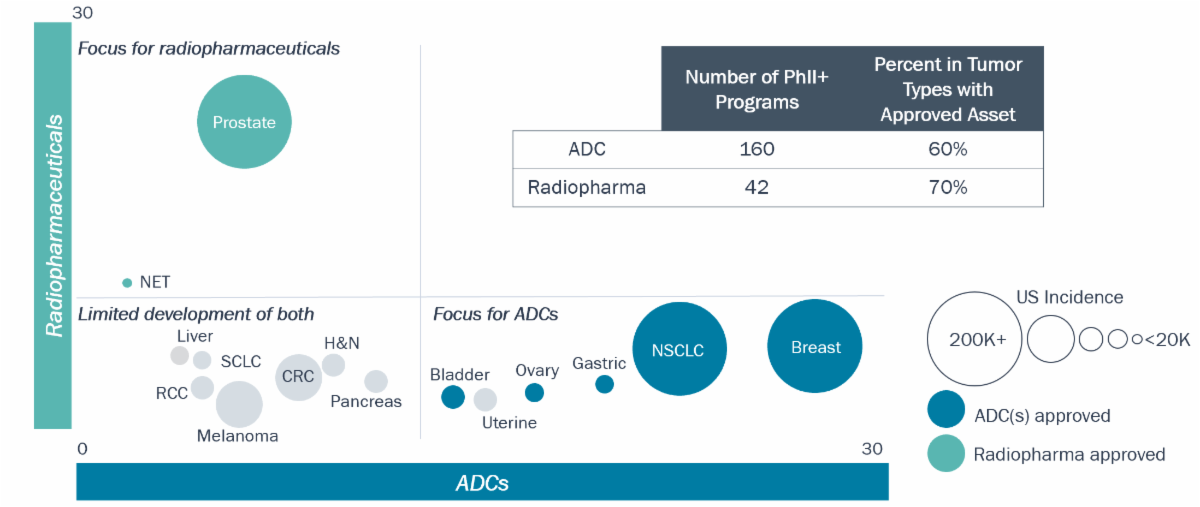

Approvals for each approach are currently for distinct solid tumors, and the majority of new programs are targeting the same tumor types

Number of ADCs and Radiopharmaceuticals in Development for Highest Incidence Solid Tumors

ASCO 2024 abstracts will provide insight into the potential of new ADCs as well as Padcev’s 1L UC regimen; new radiopharma data will be limited

ASCO 2024 Abstract Titles - ADCs and Radiopharmaceuticals

Under the hood of Padcev 1L UC regimen: Abstracts on QoL and outcomes by exposure to provide valuable insight into likely real-world treatment duration

HER2 continues to be a popular ADC target for investigation: Exploration of ADCs with brainmet activity, sequencing with other ADCs, and combining with other MOAs

New ADC targets aim to take center stage: Novel targets highlighted include cMET, B7H3, SEZ-6, CDH3, and TA-MUC1

Evidence in new tumor types: Focus remains on currently approved tumor types, but CRC and non-muscle invasive bladder cancer specific studies to be highlighted

Radiopharmaceutical related abstracts limited compared to ADCs or other modalities such as cell therapy: Further emphasizes the immaturity of this new radiopharma wave

Limited data related to new tumor types or novel therapies: Primarily focused on analysis of prostate cancer patient characteristics for currently approved treatments