September 2024

Trends in the Changing Pharmaceutical Landscape in China

- China has become a strong source of biopharmaceutical pipeline for global companies.

- BRUKINSA (BeiGene) and CARVYKTI (Legend Biotech) have demonstrated their clinical data quality leading to strong commercial performance, paving the way for licensing and acquisition deals for other Chinese biotech companies.

- China's domestic pharmaceutical market continues to experience innovations in commercial insurance and online pharmacies that expand drug access to patients.

Chinese pharmaceutical innovation has come of age and is feeding the global drug pipeline; domestic market is witnessing growth of private insurance and online pharmacies

Case 1:

Brukinsa and Carvykti have put the “made in China” innovation model on the world stage; China is now a hotbed for global BD deal sourcing.

Case 2:

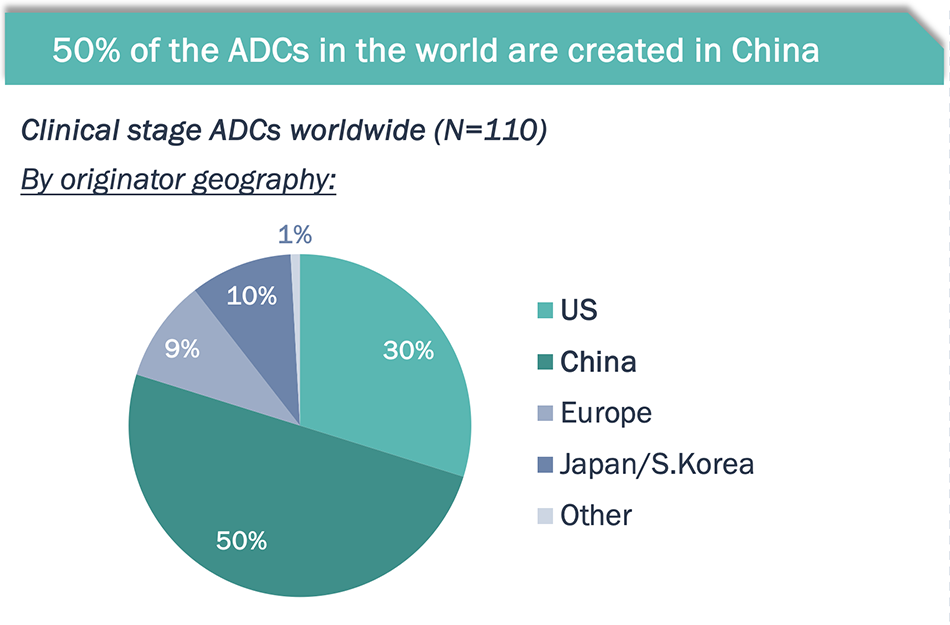

50% of the ADC pipeline is made in China; while global trials are needed, many of these ADCs are at the cutting edge of innovation.

Case 3:

Chinese biotechs are among the global leaders in CAR-T innovation, including universal CAR-T.

Case 4:

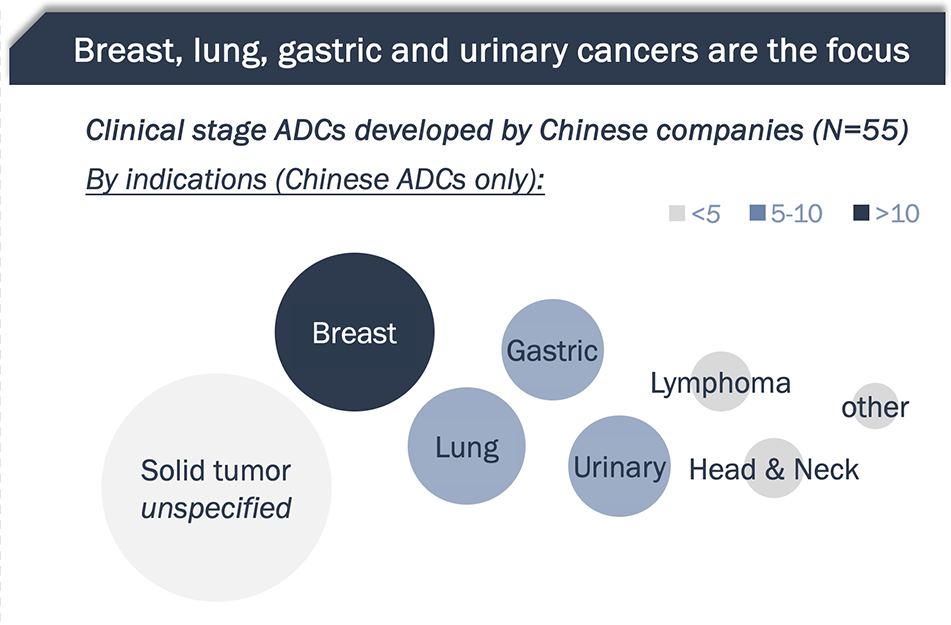

Chinese biotechs are also scaling up innovation in autoimmune and endocrine diseases, including GLP-1R targeted obesity drugs.

Case 5:

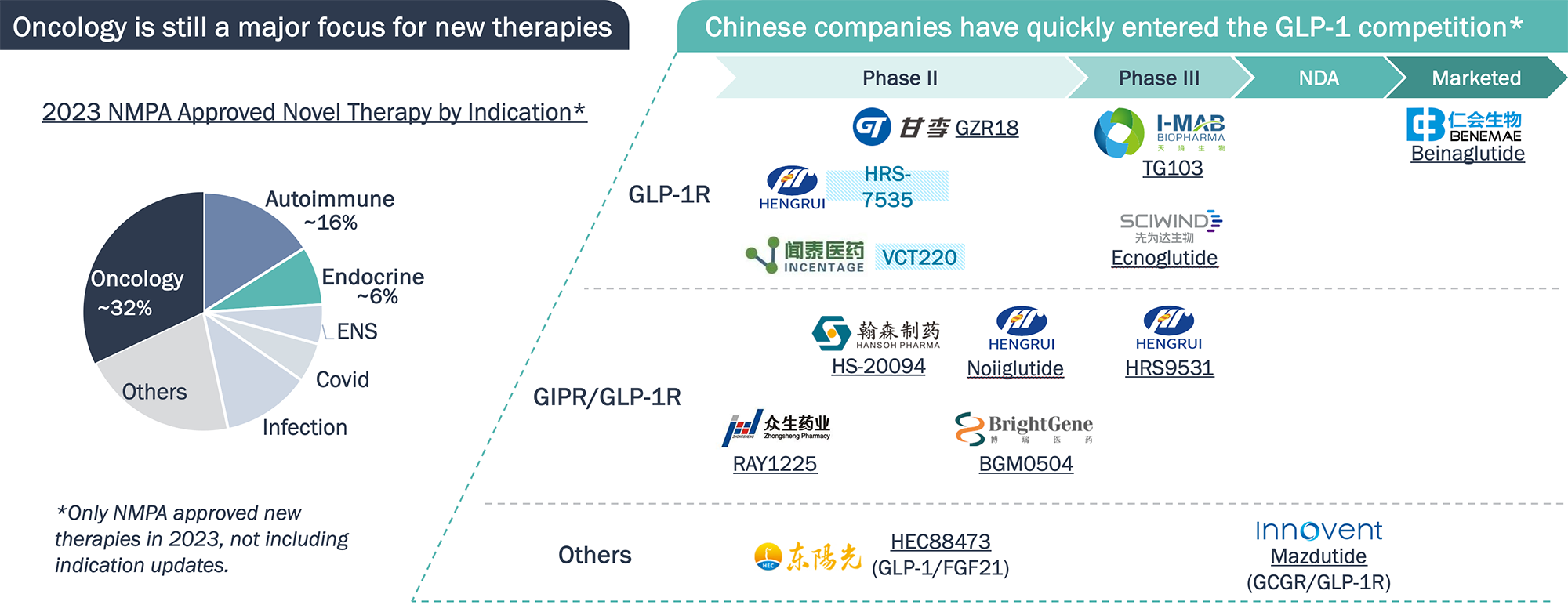

China is streamlining its accelerated approval pathways for high unmet needs drugs.

Case 6:

Orphan drugs still face patient access challenges, but regulatory and reimbursement reforms are creating a more favourable environment.

Case 7:

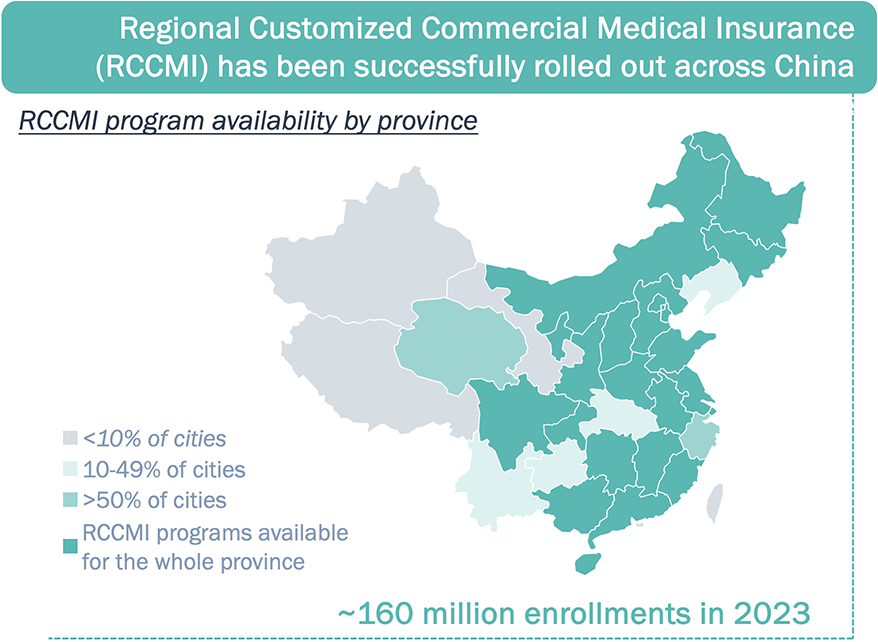

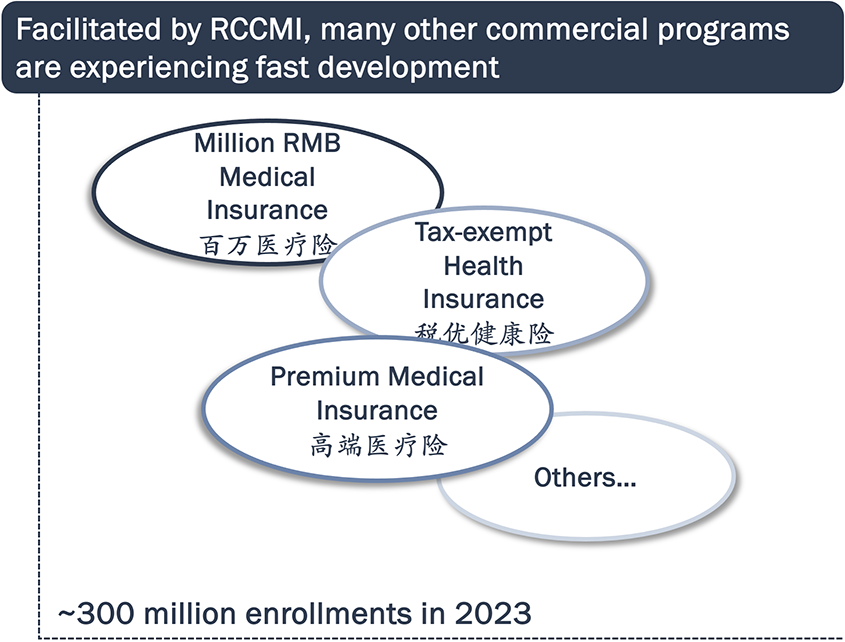

Led by RCCMI programs, private medical insurances are rapidly growing across China.

Case 8:

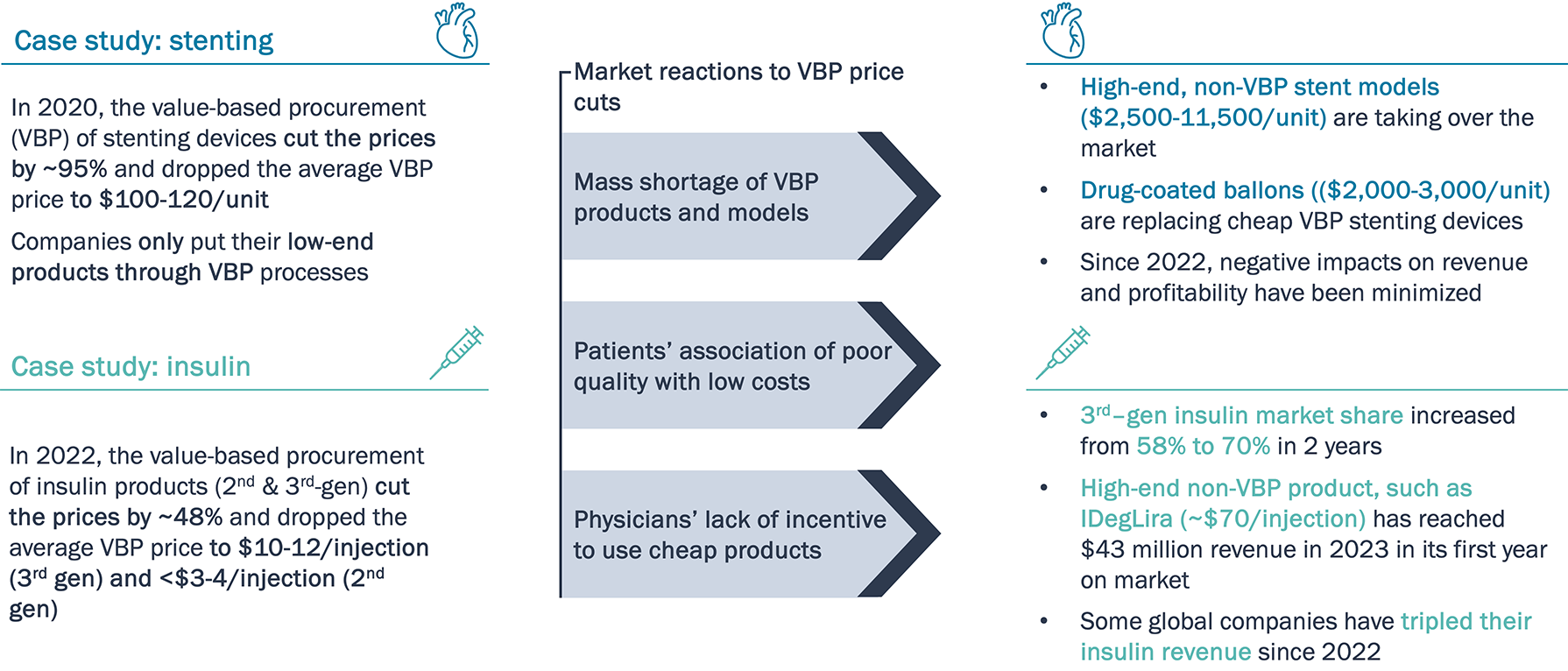

Ultra-low prices and poor quality stemming from VBP have inadvertently boosted market demand for high-end expensive products.

Case 9:

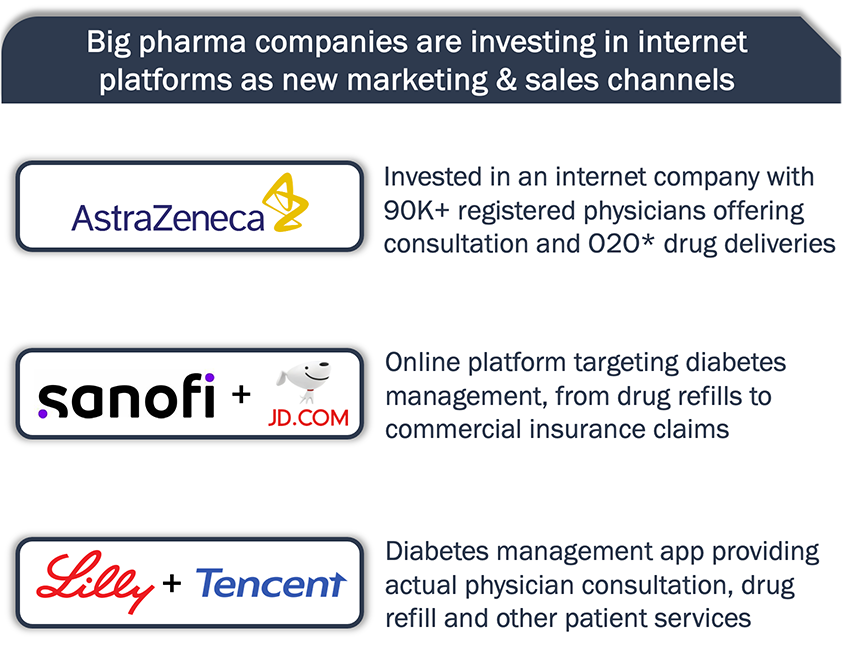

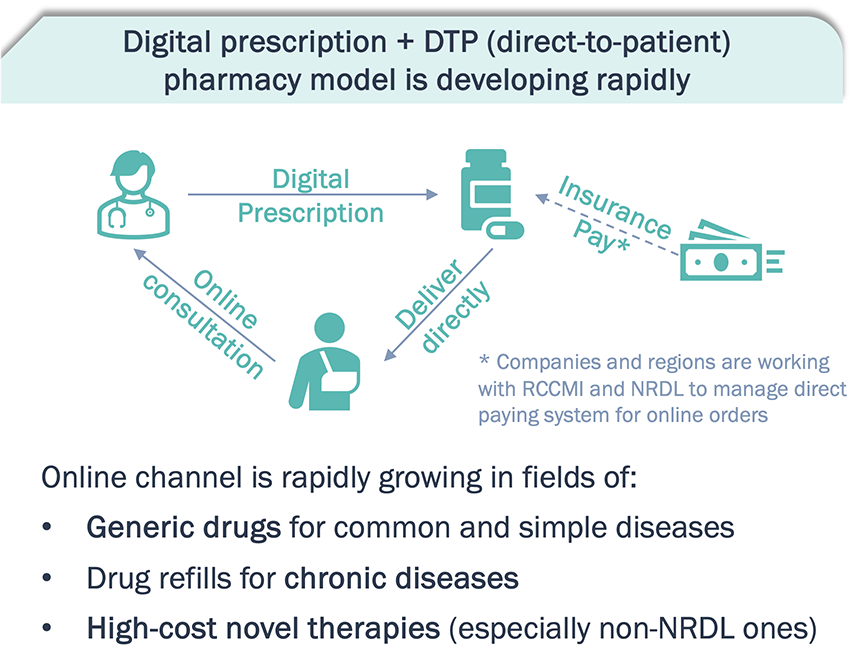

Online medical platform and DTP pharmacies are quickly developing and have become a significant drug sales channel in recent years.

Case 10:

Overall healthcare environment is evolving to be more product-centric and market-driven in China.

Note: RCCMI – regional customized commercial medical insurance; VBP – value-based purchasing; DTP - direct to patient

R&D

The “Made-in China” pharmaceutical innovation model

has

been proven in the last few years

Chinese Innovative Medicines Approved in the US/EU

Brukinsa and Carvykti have demonstrated their differentiation and strong adoption in the U.S. market.

Note: *The listed indications are up-to-date as of Jul. 2024; **Loqtorzi is only launched in US in December 2023; ***The revenue of Fruzaqla is for the fiscal year of Apr 2023 – Mar 2024.

Half of global ADCs originated in China; these Chinese ADCs are being developed for tumor types both universally prevalent and locally endemic

- HER2, Trop2, CLDN18.2 and Nectin-4 are the most frequently developed targets by Chinese ADC players

- Chinese ADC companies are also moving fast on next-generation technologies, such as bispecific ADCs

U.S. ADCs still lead the field in terms of data maturity and first-in-class status; Chinese ADCs are catching up fast with technical improvements.

Source: PharmaProjects; China ADC market deep-dive by Huajin Securities

Chinese companies are leaders in CAR-T therapies;

a few

of them are developing universal CAR-Ts

20+ Chinese companies are actively developing CAR‑T therapies with 700+ clinical trials

Among them,

many are exploring US market:

Only a few

are developing "off‑the‑shelf"

CAR‑T:

Chinese CAR-T companies are running a large number of clinical trials, including for universal CAR-Ts.

*Highest development phase only consider

their development in overseas markets, excluding China.

Note: RMAT – regenerative medicine advanced therapy;

ODD – orphan drug designation

Besides oncology, autoimmune and endocrine diseases are major areas of innovation in China. Many GLP-1R, GIPR drugs are in development, including orally delivered molecules

Key:

Chinese companies also follow global trend in choosing pipeline products and can move quickly into the “hot spots."

Note: *Generics, bio-similar products are not included; NMPA – national medical product administration (of China)

Regulatory

By 2023, NMPA has streamlined accelerated approval programs which led to rapid approvals of many innovative drugs to address high medical needs

China is speeding up the approvals for innovative drugs that meet high medical needs.

Note: *Approval time is defined as from the confirmation from NMPA for priority status until NMPA approval

China has dramatically accelerated the approval and accessibility of novel orphan drugs since 2023

China market access for orphan drugs continue to improve

China has been easing the regulatory approval and patient access to orphan drugs.

Payers

NRDL has streamlined its inclusion policies making it possible for freshly approved products to enter NRDL within 12 months of approval

Innovative products costing ≤300,000 RMB/ year can enter NRDL quickly to ramp up sales right after approval in China.

Note: *Exclusive drugs – drugs within the patent period without marketed generics

Private paying system is in development, as RCCMI programs are spreading across China and have become very popular

Many novel therapies have achieved similar or better performances relying on private paying system which does not require significant price cut.

Sources: The connotation, current situation and sustainable development of regional customized commercial medical insurance by China LIFE; RCCMI program websites.

Commercial

Severe price cuts from VBP led to product shortages, patient and physician distrust, which inadvertently boosted market position of high-end expensive products

VBP price cuts drastically boosted market share of high-end products in China.

Note: PTCA - percutaneous transluminal coronary angioplasty; DCB – drug coated balloon

The booming growth of online medical consultation platforms and internet pharmacies have become a prominent sales channel for pharma products

A consumer-oriented market for pharmaceuticals is forming. Pharma companies are developing online sales models for drug refills and patient management.

*Note: O2O – online to offline

Ecosystem

With the year-long healthcare anti-corruption campaign ending, market is rejuvenated with innovative therapies and patient services models

CDE has sped up in reviewing and processing IND and NDA applications.

Limits and executional controls on generic prices have led companies to put more efforts and investments in R&D.

Biotech companies have refocused their attention to business development, as larger ones are investing in sales and marketing while smaller ones are searching for M&A opportunities rather than looking for investors.

Drug sales and marketing are more regulated, leaving less incentives for prescribing poorerperformance drugs.

Significant improvements on efficacy, safety and QoL are highly valued.

Policymakers modify policies and regulations to balance between social responsibilities and business development.

New policies are quickly adjusted when severe market disruption emerges.

Patient-facing auxiliary services have become an important sales lever, especially among competitors with products that offer similar perceived benefits.

Chinese pharma market is heading towards a more regulated, product-based and market-driven environment, refocusing competition on product performance and patients.

Acronyms

- BC – breast cancer

- CDE – center for drug evaluation, NMPA

- CLL – chronic lymphocytic leukemia

- DLBCL – diffuse large B-cell lymphoma

- DTP – direct to patient

- ESCC – esophageal squamous cell carcinoma

- FL – follicular lymphoma

- FMF – familial Mediterranean fever

- MCL – mantle cell lymphoma

- mCRC – metastatic colorectal cancer

- MM – multiple myeloma

- MZL – marginal zone lymphoma

- NF1 – neurofibromatosis type 1

- NMPA – national medical products administration

- NPC – nasopharyngeal carcinoma

- NRDL – national reimbursement drug list

- ODD – orphan drug designation

- PN – plexiform neurofibromas

- RCCMI – regional customized commercial medical insurance

- RMAT – regenerative medicine advanced therapy

- SLL – small lymphocytic lymphoma

- VBP – value-based purchasing

- MM – multiple myeloma

- WM – Waldenstrom macroglobulinemia