October 2024

A Growing Pipeline for Shrinking Waistlines:

Solving the Unmet Needs in

Obesity Treatment

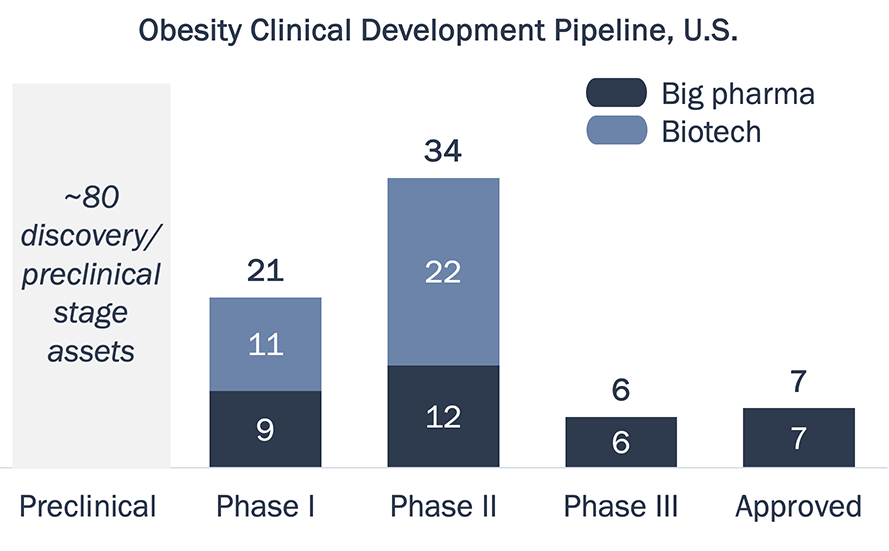

The GLP-1 receptor agonist drug class has revolutionized obesity treatment, and has spurred investment and innovation across the pharmaceutical industry. However, there persist key unmet needs facing this treatment landscape, with varying levels of complexity. Will any of the 50+ clinical-stage assets currently in development meet these unmet needs?

The growth of the GLP-1 receptor agonist class in the obesity market has spurred investment and innovation across the healthcare industry

Overview of the Obesity Market and Development Pipeline

By 2035, ~50% of the U.S. population and ~25% of the global population is expected to have obesity1, defined as a BMI ≥ 30 kg/m²

The obesity market is dominated by Wegovy, with 2023 U.S. sales of ~$4.3B, and recently approved Zepbound (~$1.7B 1H24); GLP-1s are predicted to become the best-selling drug class of 2024 (inclusive of diabetes and obesity)2

The late-stage obesity pipeline is dominated by big pharma, and 8 of the top 20 pharma companies have a clinical stage asset in development

The obesity pipeline has almost tripled in size since June 2023, and there are up to 6 new U.S. approvals expected in next 3-5 years3

Abbreviations: GLP-1

RA—GLP-1 receptor

agonist. BMI—body mass index.

Source: (1) World Obesity Atlas 2023; (2) GlobalData; (3) Stifel

Obesity Market

Review, July 8th; PharmaProjects; TrialTrove.

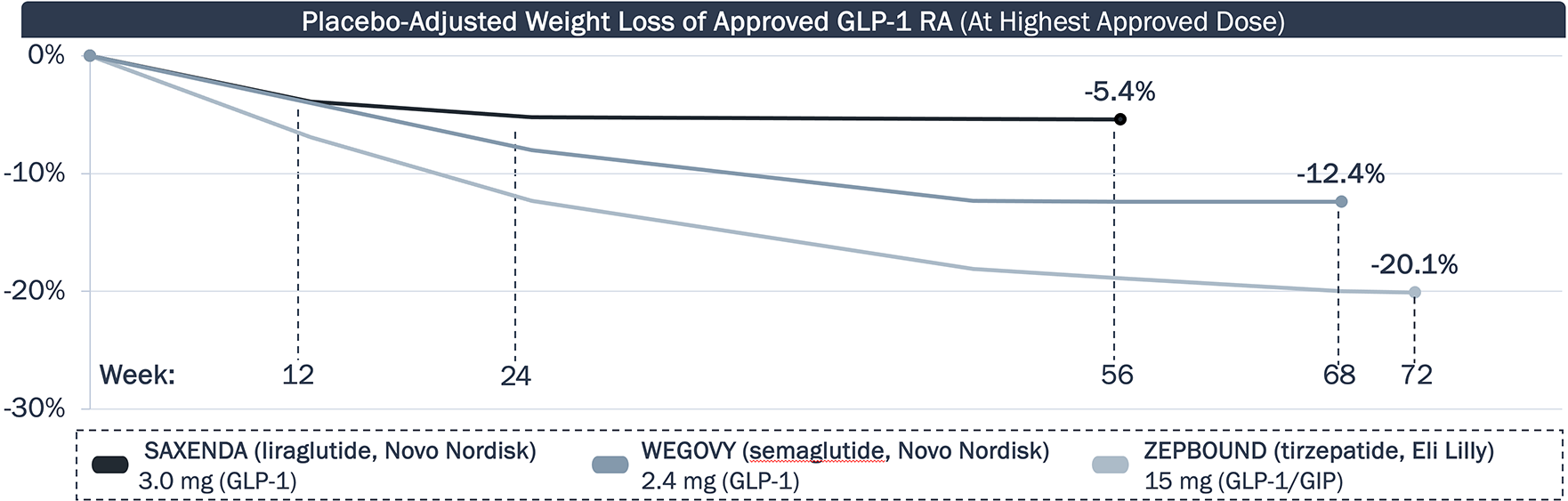

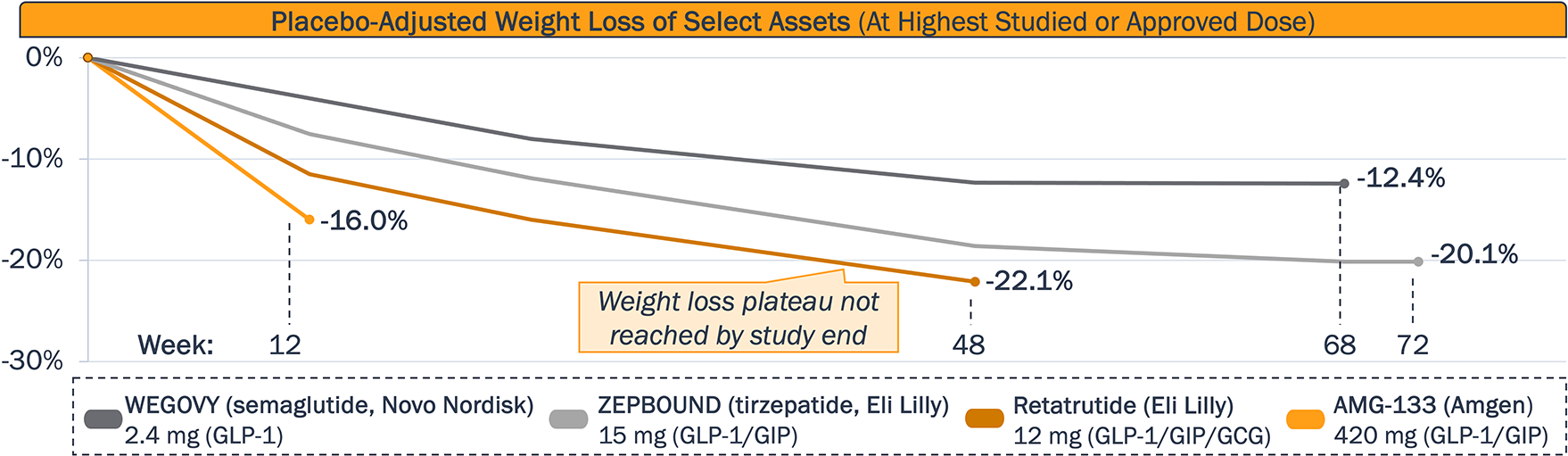

GLP-1 RA approved for obesity have steadily improved upon weight loss, but clinical data suggests there is an efficacy plateau

Weight Loss Efficacy of Approved GLP-1 RA

While approved agents have improved upon weight loss, data suggest the efficacy will plateau. Will new obesity therapies extend the period of weight loss? Will this impact any weight gain rebound?

Abbreviations: GLP-1

RA—GLP-1 receptor agonist(s).

GIP—Gastric inhibitory peptide.

Source: Jastreboff et al., NEJM (2022); Wilding et al., NEJM (2021);

Pi-Sunyer et al., NEJM (2015); product package inserts;

company press releases.

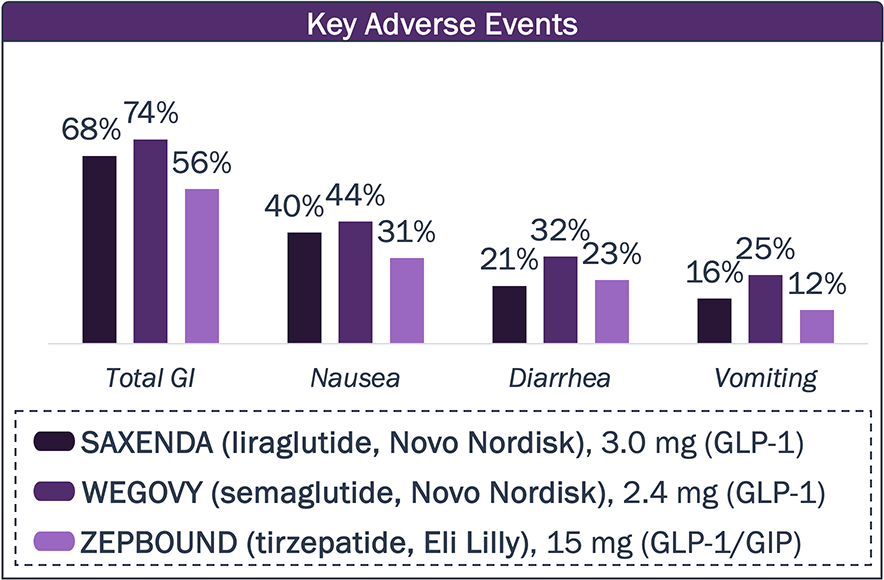

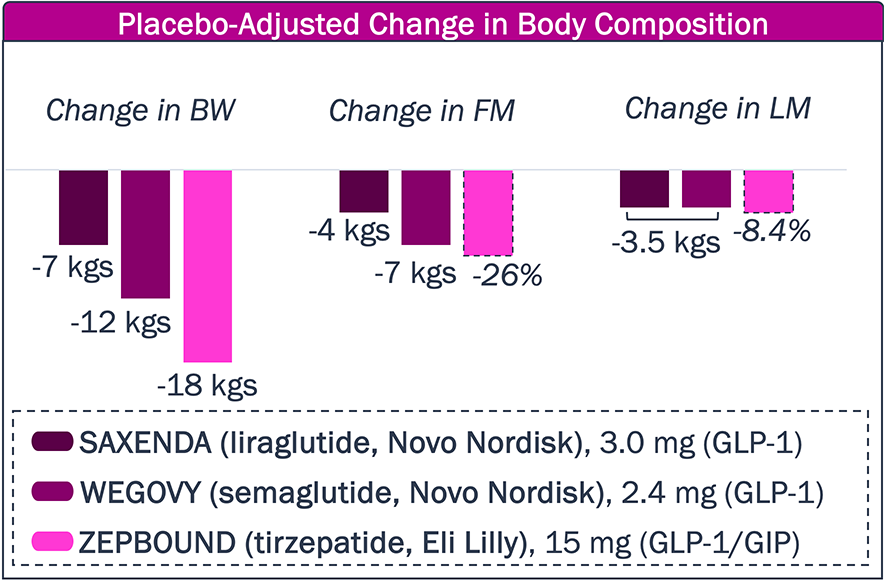

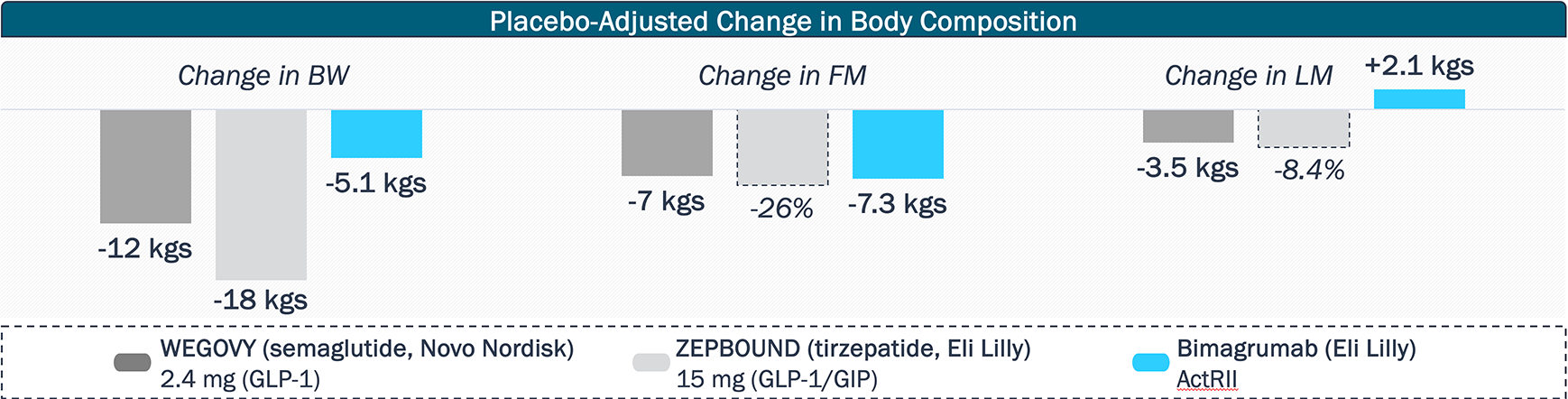

While approved agents can provide substantial decrease in BW, a significant portion is due to loss of lean mass, and the high frequency of GI AEs remains a challenge

Approved Obesity Agents – Side Effects

Patients are dissatisfied with gastrointestinal side effects, creating a major challenge for approved obesity drugs.

Will new drugs lower the frequency of these side effects?

Approved obesity drugs have improved upon body weight reduction, but, in part, at the expense of lean muscle.

Will new obesity agents further limit or prevent lean muscle mass reduction?

Abbreviations: BW—Body

weight. FM—Fat mass. LM—Lean

muscle. GLP-1 RA—GLP-1 receptor agonist(s).

GIP—Gastric inhibitory peptide.

Source: Jastreboff et

al., NEJM (2022); Wilding et al.,

NEJM (2021); Jensen et al.,

JAMA Netw Open (2024); Pi-Sunyer et

al., NEJM (2015); clinicaltrials.gov; package inserts; company press

releases and websites.

While the GLP-1 RA class has revolutionized the obesity treatment landscape and industry, there remain key unmet needs that may be addressed by novel agents in development

Obesity Landscape – Unmet Needs

1

Dosing/

Convenience

- Current approved therapies for patients with obesity require weekly subcutaneous injections, and the overwhelming success of the GLP-1 market demonstrates that many patients with obesity are comfortable with a weekly injection

- However, there are still segments of patients who require less frequent dosing for improved adherence, or oral agents instead of injections due to an aversion to needles

2

Increased Weight Loss

- Approved GLP-1 RA for obesity demonstrate a plateau in efficacy of 12-20% body weight loss at ~1.5 years; some patients are also refractory to GLP-1 RA, or desire additional weight loss than what is already achievable

- Furthermore, there is a need to minimize the “rebound effect” with GLP-1 RA, where patients who stop treatment rapidly regain most, if not all, of the weight they lost while on drug

3

Muscle Preservation and Body Composition

- Weight loss achieved with GLP-1 RA class is an indiscriminate combination of both fat and lean muscle, with 25-40% of total body weight loss due to loss of lean muscle

- As the market matures, there will likely become a need for next-gen obesity drugs and combinations to preserve lean muscle mass, improve body composition, and avoid other potential adverse health events (e.g., low bone density)

Abbreviations: GLP-1 RA—GLP-1 receptor agonist(s).

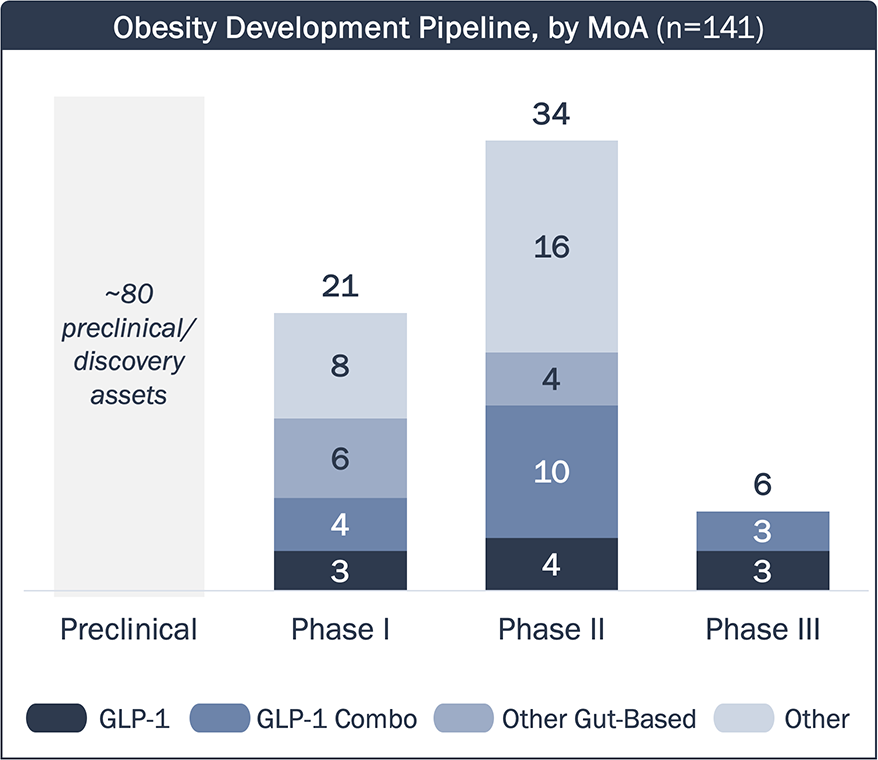

There are 6 incretin-based Phase 3 assets in development for obesity; earlier phase assets target other gut-based hormones, or leverage novels MoAs to complement GLP-1 weight loss

Obesity Clinical Development Pipeline – MoA

- GLP-1 RAs in development are either “me-too” drugs, or aim to differentiate themselves from approved agents with dosing and/or RoA.

- Many assets in development utilize a GLP-1 RA backbone in combination with additional incretin targets (e.g., GIP).

- These assets may enhance the efficacy of GLP-1 RA, but may have similar side effects (e.g., GI events, muscle loss).

- A few assets target other gut-based hormones (e.g., amylin) responsible for regulating appetite and energy.

- These assets may lead to differentiated efficacy/tolerability profiles compared to GLP-1 RAs, but they are still bound within the limitations of targeting gut-based hormones.

- Many assets have novel MoAs outside of incretin mimetics and other gut-based hormone targets (e.g., ActRII, apelin).

- These assets can complement the efficacy of incretin mimetics while minimizing other effects caused by incretin agonism (e.g. muscle loss, low bone density).

Abbreviations: GLP-1

RA—GLP-1 receptor agonist(s).

GIP—Gastric inhibitory peptide.

GCG—glucagon.

GI—gastrointestinal.

ActRII—Activin

Type II. PYY—Peptide YY. RoA—route

of administration.

Source: PharmaProjects; TrialTrove. Development pipeline includes

assets in development in the U.S. and/or EU.

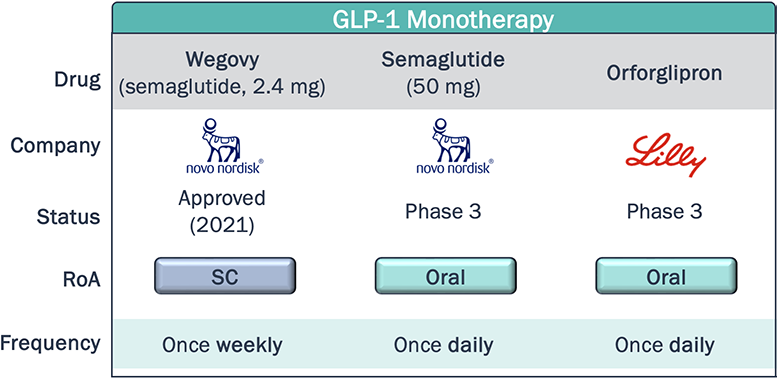

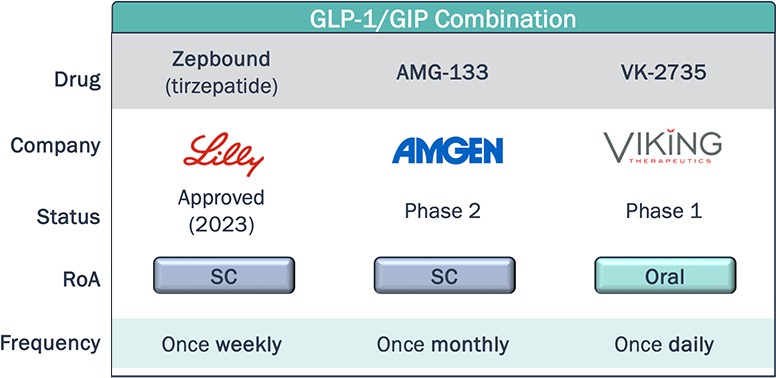

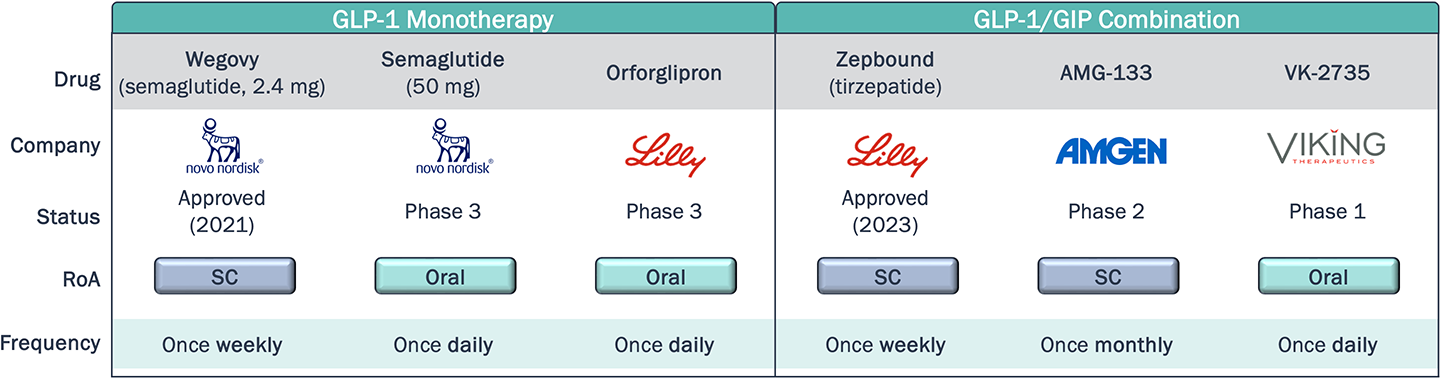

Novel agents within the same class as approved therapies aim to differentiate themselves through dosing, either with less frequent dosing, or switching from SC to oral RoA

Obesity Clinical Development Pipeline – Dosing and Convenience

*Non-exhaustive

As of August 2024, Rybelsus—an oral formulation of semaglutide for T2D—captured 7% of the U.S. GLP-1 RA T2D market (~4.5 yrs post-launch). Is the share obtained by Rybelsus indicative of low demand for oral agents in this class, or will novel oral therapies, with improved efficacy, safety, and convenience profiles (e.g. may be taken without food restrictions) achieve greater utilization?

What will the market demand be for a once-monthly subcutaneous injection compared to once weekly, and what impact will this have on adherence and compliance?

Abbreviations: GLP-1

RA—GLP-1 receptor agonist(s). T2D—Type

2 diabetes. RoA—route of administration.

GIP—Gastric inhibitory peptide.

SC—Subcutaneous.

Source: TrialTrove; Company reports and presentations.

Although there are no head-to-head studies, published data indicates dual/triple incretin agonism achieves faster weight reduction and max weight loss than GLP-1 agonism alone

Obesity Clinical Development Pipeline – Weight Loss

Will early data shown by Lilly’s “Triple G” retatrutide (Phase 3) and Amgen’s AMG-133 (Phase 2) be recapitulated in ongoing studies to demonstrate both faster weight loss and greater total weight loss, compared to approved GLP-1 RA?

Given Lilly’s retatrutide did not reach a weight plateau at the time the Phase 2 study ended, what is the maximum weight loss achievable with longer follow-up? Will a plateau be reached?

Which of the GLP-1-based therapies can achieve the most desirable weight loss balanced with a manageable safety profile (e.g., GI events) and favorable dosing schedule?

Abbreviations: GLP-1

RA—GLP-1 receptor agonist(s).

GIP—gastric inhibitory polypeptide.

GCG—glucagon.

GI—gastro-intestinal.

Sources: Veniant et al., Nat Metab, 2024; Jastreboff et al., NEJM,

2023; Wilding

et al., NEJM, 2021; Jastreboff et al., NEJM, 2022.

Multiple assets with novel MoAs are being developed in combination with incretin mimetics to improve body composition and reduce lean muscle loss compared to GLP-1 agonism alone

Obesity Clinical Development Pipeline – Muscle and Body Composition

Other assets focused on preventing muscle loss in combination with incretin mimetics include Regeneron’s Phase 2 trevogrumab (myostatin) + garetosmab (ActA) combination, BioAge’s Phase 2 azelaprag (APJ), and Scholar Rock’s Phase 2 apitegromab (myostatin).

How much market share will muscle preserving agents carve out, and how will the multiple programs and MoAs differentiate themselves?

In addition to improved body composition and reduction in lean muscle loss, will muscle preserving agents demonstrate health benefits currently not achieved with incretin mimetics, such as sustained weight loss or increased bone density?

Abbreviations:

GIP—Gastric inhibitory peptide.

ActRII—Activin receptor type 2.

ActA—Activin A. APJ—apelin

receptor. BW—Body weight.

FM—Fat mass. LM—Lean muscle.

MoA—Mechanism of action.

Source: Heymsfield et al., JAMA, 2021; Wilding et al., NEJM, 2021;

PharmaProjects; Company reports and presentations.

As the obesity market matures, we will likely see improvements of current unmet needs, but key questions will need to be addressed to fully understand patient, HCP, and payer dynamics

Obesity Landscape - Final Thoughts

Dosing

The GLP-1 RA obesity market, driven by injectables, has seen historic levels of success, and near-term entrants are likely to provide more dosing options within the GLP-1 or GLP-1/GIP class

Weight Loss

Novel drugs in development are likely to be approved within the next 5 years, with improved weight loss efficacy compared to what Wegovy and Zepbound have demonstrated

Body Comp

The coming years will likely see increased data on muscle preservation and the quality of weight loss with novel MoAs, even if used in combination with GLP-1/incretin-targeting agents

As the obesity market matures, how will patients think about the tradeoffs between efficacy, safety, and dosing/convenience with the availability of new drugs and more data?

In a market driven by community HCPs, how do their perspectives compare to those of academic HCPs, and what influence do academic HCPs have on the overall prescribing patterns with multiple options on the market?

How is payer appetite to cover obesity medications changing, and how does insurance coverage impact patient/provider choice of medication?

Abbreviations: GLP-1 RA—GLP-1 receptor agonist(s). GIP—Gastric inhibitory peptide. HCP—Healthcare provider. MoA—Mechanism of action.