March 2025

New Oncology Agents – A Look Back and the Year Ahead

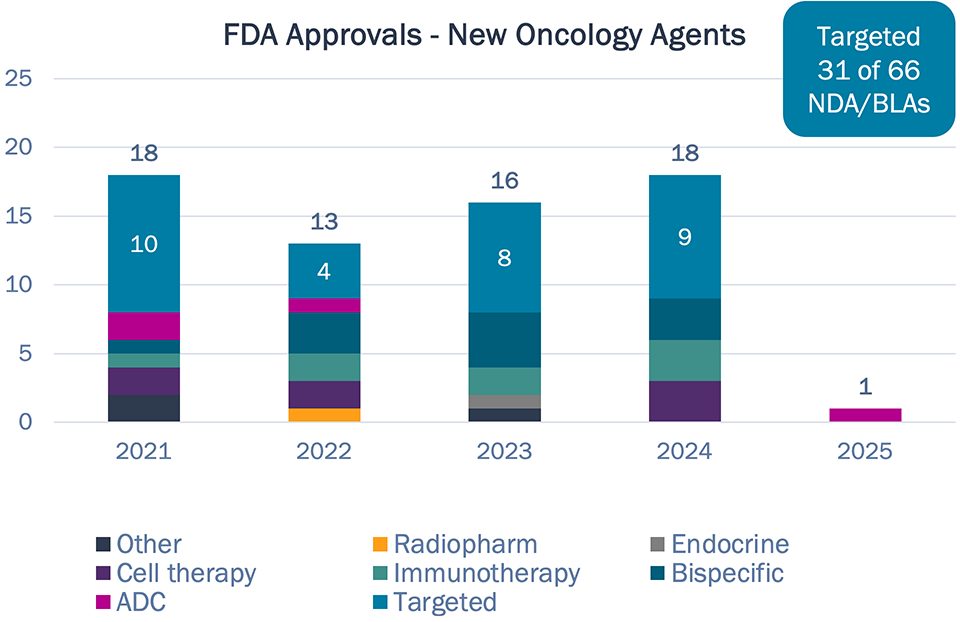

- 2024 saw 18 new drugs approved for oncology, nine with novel MOAs.

- 13 new drugs are currently pending before FDA, with only four new MOAs among them, including the potential first MET ADC.

- Beyond these potential near-term launches, key trends that could shape the year ahead include the march of novel therapies into the early stage setting, emergence of novel KRAS inhibitors, and China dealmaking.

Targeted therapy has been the driver of new oncology approvals in recent history, but a more diverse mix of MOAs have been approved in the past few years

New Oncology Agents – 2021 to Present

Targeted therapies account for <50% of new approvals in past 5 years, down from >65% in the prior 5 years

Half of drugs approved in 2024 had novel targets, like DLL3 and claudin18.2

The first cell therapies and T-cell engager for solid tumors approved in 2024

Wave of ADC dealmaking not yet impacting practice — Datroway only new ADC in three years, with established TROP2 target

Source: FDA; Bluestar analysis

9 of 18 drugs approved in 2024 have novel MOAs, including the first cell therapies and T‑cell engager for solid tumors

2024 New Oncology Agents

| Targeted | Cell/Gene Therapy | IO | Bispecific | ADC | Endocrine | Radiopharm/Other | |

|---|---|---|---|---|---|---|---|

| Approved |

Ojemda (RAF) Rytelo (telomerase) Voranigo (IDH1/2) Niktimvo (CSF1R) Lazcluze (EGFR) Itovebi (PI3K) Revuforj (menin) Vyloy (claudin 18.2) Ensacove (ALK) |

Amtagvi (TILs) Tecelra (MAGEA4) Aucatzyl (CD19) |

Anktiva (IL-15) Tevimbra (PD-1) Unloxcyt (PD-L1) |

Imdelltra (DLL3xCD3) Ziihera (HER2xHER2) Bizengri (HER2xHER3) |

|||

| Rejected/ Deferred |

Rivoceranib (VEGF) |

Camrelizumab (PD-1) |

Odronextamab Linvoseltamab |

Patritumab-DXd |

Iopofosine |

Above: Bold – novel target

Select Novel MOAs:

- Imdelltra (tarlatamab - DLL3xCD3; Amgen): T-cell engager for 2L+ SCLC brings back to life ~5 years after failure of StemCentrx’s Rova-T ADC

- Zolbetuximab (claudin18.2; Astellas): Approval in gastric cancer was held up by a CMC issue; carves out a new segment in this high unmet need tumor type; potential to expand into other GI tumors and many claudin 18.2 ADCs hot on its heels

- Amtagvi and Tecelra: First solid tumor cell therapies (TILs and TCR, respectively) will provide insight into market dynamics for autologous therapies

Source: TrialTrove; FDA; company press releases; Bluestar analysis

Fewer new MOAs are anticipated in 2025, while the oral SERD class in HR+/HER2- breast cancer is poised for significant competition, with 4 pivotal readouts/approvals on the horizon

2025 New Oncology Agents

| Targeted | Cell/Gene Therapy |

IO | Bispecific | ADC | Endocrine | Radiopharm/Other | |

|---|---|---|---|---|---|---|---|

| Approved |

Datroway (TROP2) |

||||||

| Filed |

Avutometinib (RAS) + Defactinib (FAK) Dordaviprone Sunvozertinib Taletrectinib (ROS1) Zongertinib (HER2) |

Penpulimab (PD-1) RP-1 (oncolytic virus) |

Linvoseltamab Odronextamab |

Blenrep (BCMA) Telisotuzumab |

Imlunestrant (oSERD) |

Mitomycin gel |

|

| Filing Expected |

Ziftomenib (menin) Rusfertide (hepcidin) |

Sasanlimab (PD-1) |

Camizestrant Vepdegestrant |

||||

| Pivotal Readout Expected in 2025 |

Ceralasterib (ATR) Zongertinib (HER2) Zanzalintinib (multi-TKI) Bemarituzumab (FGFR) Iberdomide (CELMoD) |

Fianlimab (LAG-3) |

Zilovertamab vedotin |

Giredestrant |

Above: Bold – novel target

Fewer new MOAs poised for approval compared to last year.

Select Novel MOAs:

- Ceralsertib (ATRi, AZ): Looking to replicate the success of Ph2 Hudson trial in PD-1 pretreated NSCLC

- Bemarituzumab (FGFR, Amgen): Could bring a new biomarker to the gastric cancer landscape, though initial Ph3 does not include now SoC PD‑1

- Two new potential ADC targets: MET (teliso-v; AbbVie) for NSCLC and ROR1 (zilovertamab vedotin; Merck) for DLBCL

Source: TrialTrove; FDA; company press releases; Bluestar analysis

Key Trends and Questions for 2025

Key Trends...

...Emerging Questions

Early-stage setting takes center stage with IO and targeted therapy approvals

How will ODAC ‘contribution of parts’ recommendation impact trial designs? Are surrogates like pCR, ctDNA ready for prime time?

Cracking KRAS: next-gen G12C, first G12D and pan‑(K)RAS emerging

Pros and cons of pan vs. specific inhibitors? How will order of entry impact opportunity and sequencing by tumor type?

Beyond PD-(L)1: SC formulations as lifecycle plays; many players chasing VEGF bispecifics

Can VEGF bispecific/bifunctional approach deliver improved outcomes as PD-(L)1 LOEs near?

China licensing deals continue—picking up potentially “super me-too” assets in hot classes

Are innovative molecules on the way? How long will the China licensing wave last given domestic funding environment?

TROP2 disappointments and TOP1 sequencing data take ADC enthusiasm down a notch

Have we reached saturation for TOP1 payloads in clinical development? What novel payloads could emerge?

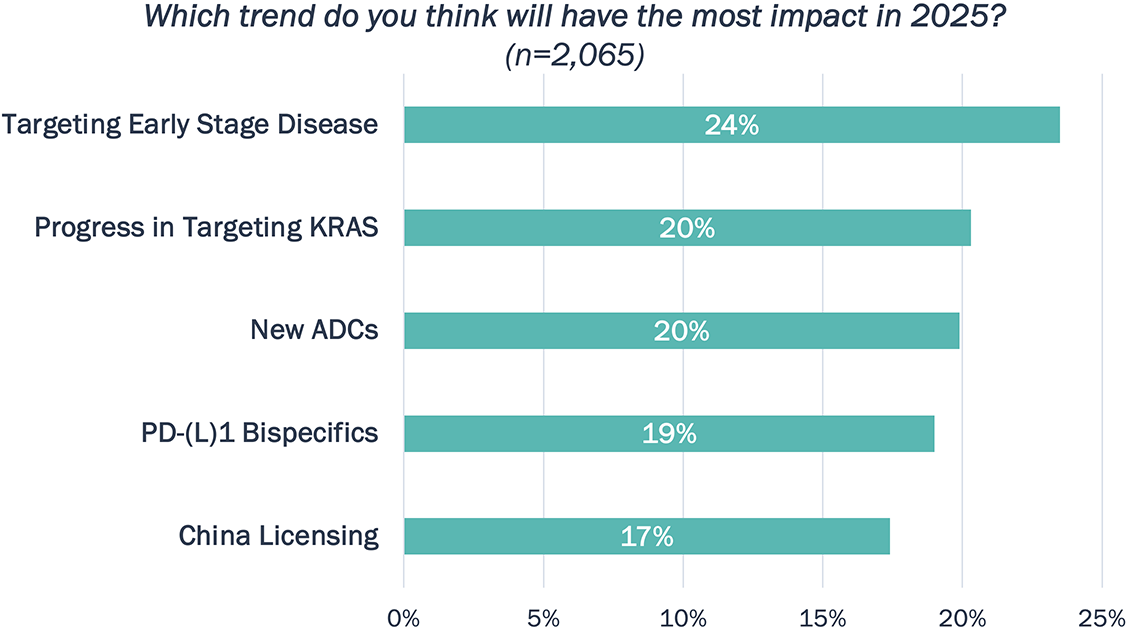

Based on our client poll, targeting early-stage disease is expected to have the most impact this year, though voting is close across the trends!

Poll Results